You can use your credit card safely and even to your benefit, by Understanding the card you have Protecting your card physically and digitally Tracking your spending Investing in fraud protection Here is what you need to know about using a credit card safely to improve your credit score and prevent fraud. How credit cards […]

FICO or Credit Score | What’s the Difference, Anyways?

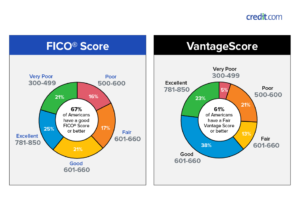

In the world of personal finance, it is easy to get confused by all the different terms and ratings. One of the most common questions people ask is this: what is the difference between a FICO score and a credit score? The truth is that they are both rating systems. Which credit rating system will […]

5 Tips for Maintaining a Good Credit Score

Having a good credit score is the key to being able to buy just about anything you could want, within reason of course. Your credit score affects things like your ability to take out a mortgage, rent an apartment, or buy a car. In some cases, your credit score can even influence your chances of […]

“18 Months Same as Cash!” … Really?

Is zero interest for 18 months REALLY zero interest? If you can walk a tightrope while juggling flaming torches, then maybe. But beware — many of these offers are fraught with conditions that will make your head spin. Best Buy, for example, is currently offering 18 months zero interest on all purchases over $429. However, […]

Are Your Credit Card Rewards Really Rewarding You?

When my friends tell me how much money their credit card companies pay them each month, I ask myself, “What is the catch?” After all, credit card companies are not in the business of losing money. Is it possible…really possible…to make credit card companies pay? Even though I don’t own any credit cards, I am […]