Understanding your debt-to-income (DTI) ratio is important. Your DTI compares the amount of money you owe to your monthly income. It is a percentage that represents your gross monthly income.

Everyone should know what their DTI is to promote financial growth and make better decisions with their money. If you do not know yours, it is easy to figure out and understand.

What is a debt-to-income ratio?

Your DTI ratio is an essential personal finance tool. Many lenders will calculate it before deciding whether they can offer you a loan.

Lenders use your DTI ratio it to gauge your creditworthiness.

DTI measures how your debts and income compare to one another. Most lenders want potential clients to use a certain percentage of their money towards debts. It varies between loan types, but for a mortgage, you will want your DTI lower than 36% to have good odds of getting the loan.

If your DTI is too high, you will feel like you are constantly struggling to save money. Most of what you earn goes towards your debts.

How to calculate your debt-to-income ratio

Luckily, calculating your debt-to-income ratio on your own is straightforward. It should also be reasonably accurate if you account for everything.

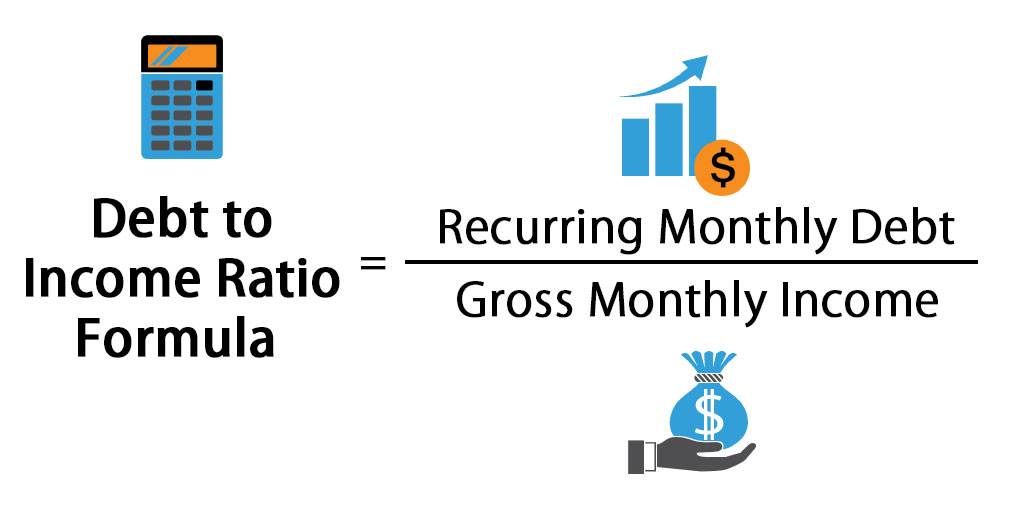

To figure out your DTI ratio, you can use this simple formula:

Monthly debt payments ÷ gross monthly income

First, you will need to find your gross monthly income. You can take your yearly pay and divide it by 12 to get the right amount.

From there, you can divide the annual pay by 52 to get your gross monthly income.

To find your monthly debt payments, you will need to add up everything you spend each month. These could include car payments, rent, mortgages, credit cards, and other bills.

Calculating your DTI ratio

We will walk through an example together. In this example, you have a gross monthly income of $3,000 and the following monthly expenses:

- $800 housing expense

- $150 car payment

- $250 student loan payment

- $100 credit card payment

These debts add up to equal $1,300. Now, you will want to divide that by your gross monthly income:

$1,300 ÷ $3,000 = 0.4333333

That is 43% for your DTI, which is a little on the high side. You will want to keep your DTI below 40% to maintain a good quality of life. In this example, you could bring your DTI down by making more payments on the debts that you owe.

Overall, figuring out your DTI ratio is simple. However, it would help to track your expenses and gross monthly income to get the most accurate percentage.

Why debt-to-income ratios are important

There are many reasons why your debt-to-income ratio is essential. First, you can use it as a financial tool to plan your future. Lowering your DTI is always a good use of your time and resources. Moreover, when you have fewer debts, you have a better quality of living.

https://time.com/nextadvisor/mortgages/debt-to-income-ratio/

Plus, many financial institutions and lenders will look at your DTI when you approach them for loans. These loans could include car and mortgage loans, which most people need at some point in their lives.

You do not want to be denied a vital loan because of your DTI! But, if you can, it is best to start lowering your DTI ratio sooner rather than later.

Final thoughts

To summarize, your debt-to-income ratio reflects how much you owe vs. how much you make. If it is higher than 40%, it makes it tough to save money. Plus, you are less likely to receive loans that you might need in the future.

Leave a Reply