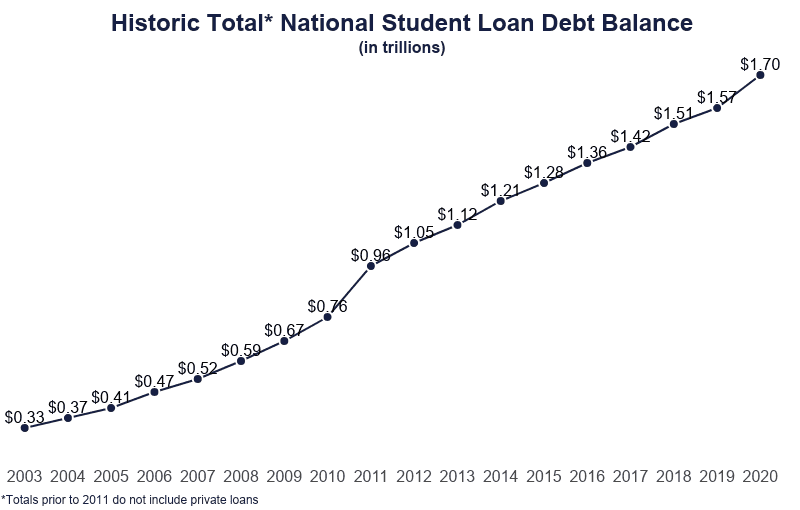

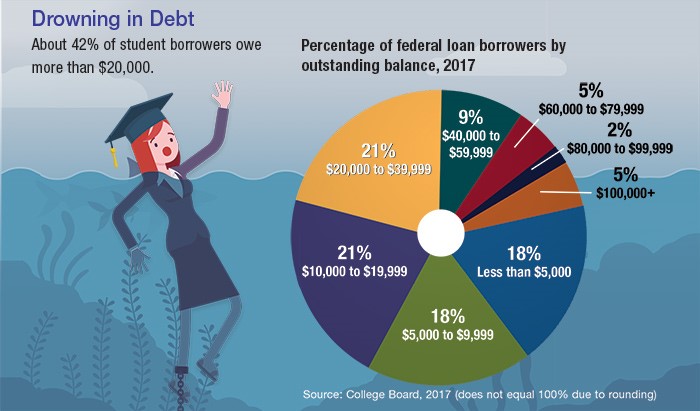

Currently, many young adults are accumulating debt to go to college. They take out loans and often have trouble paying off those loans after graduation.

There are some options for cash-strapped graduates. For some, loan deferment is a lifesaver. For others, it only causes more problems.

What Is Student Loan Deferment?

Student loan deferment is when someone cannot afford to make their monthly loan payments. Some, but not all, public and private loaners offer loan deferment. Loan deferment pauses payments for a set amount of time.

In some cases, deferment means no payments at all. In other cases, it means you only need to make payments on the interest accrued. Therefore, this can mean making smaller payments.

Why Do People Choose to Defer Their Loans?

There are many reasons someone might choose to defer their loan. The main reason is always a lack of funds to make the loan payments. However, any defer their student loan to pay for more immediate needs such as rent and other bills.

Why Is Deferring Your Loans a Bad Idea?

There are a few key reasons why student loan deferment can cause problems.

- The first is that you may continue to accrue interest while the loan is deferred depending on the type of loan. This leads to having to pay back more money in the end.

- Another problem with loan deferment is that it increases the time you will spend repaying your loan.

- Here is an example: If you defer your loan for six months and then start paying again, you will be picking up where you left off. If you had ten years left to pay your loan, you still have ten years, but now you have more to pay because of interest.

- Lastly, if you are enrolled in any student loan forgiveness program deferring your loan can affect when you receive your forgiveness.

- Some loan forgiveness programs require a minimum amount to be paid or a minimum number of payments to be made. If you defer your loan, you are also postponing your forgiveness.

What Other Options Are Available?

There are a few different ways to solve the problem of Student Loan Payments that may be too high. The main ones are working out a repayment plan, income-driven repayment plans, forbearance, employer payment programs, and refinancing.

Repayment Plans

Payment plans are one of the best ways to work out student loan problems. If you struggle to meet your monthly payment, figure out how much you can afford to pay down.

Contact your Loan provider and ask to speak to someone about creating a repayment plan.

One of the pros of getting a repayment plan is paying a smaller amount each month. But, one of the downsides is that it will increase the time you will spend repaying your loan.

Something to consider: if you can pay more than the minimum payment at any point, you should do so. This will help your loan get paid off faster.

Income-Driven Repayment

Income-Driven Repayment is available if you have Federal Student Loans. You can request this payment plan form if you are struggling to make ends meet due to low income.

Your loan adviser will look at your income and expense statements and help you develop a repayment plan you can afford.

Pros of Income-Driven Repayment include a lower monthly bill based on your income. However, a downside of this type of repayment is when your income goes up, you must make more payments. In some cases, this increase can help, and in others, it can hurt.

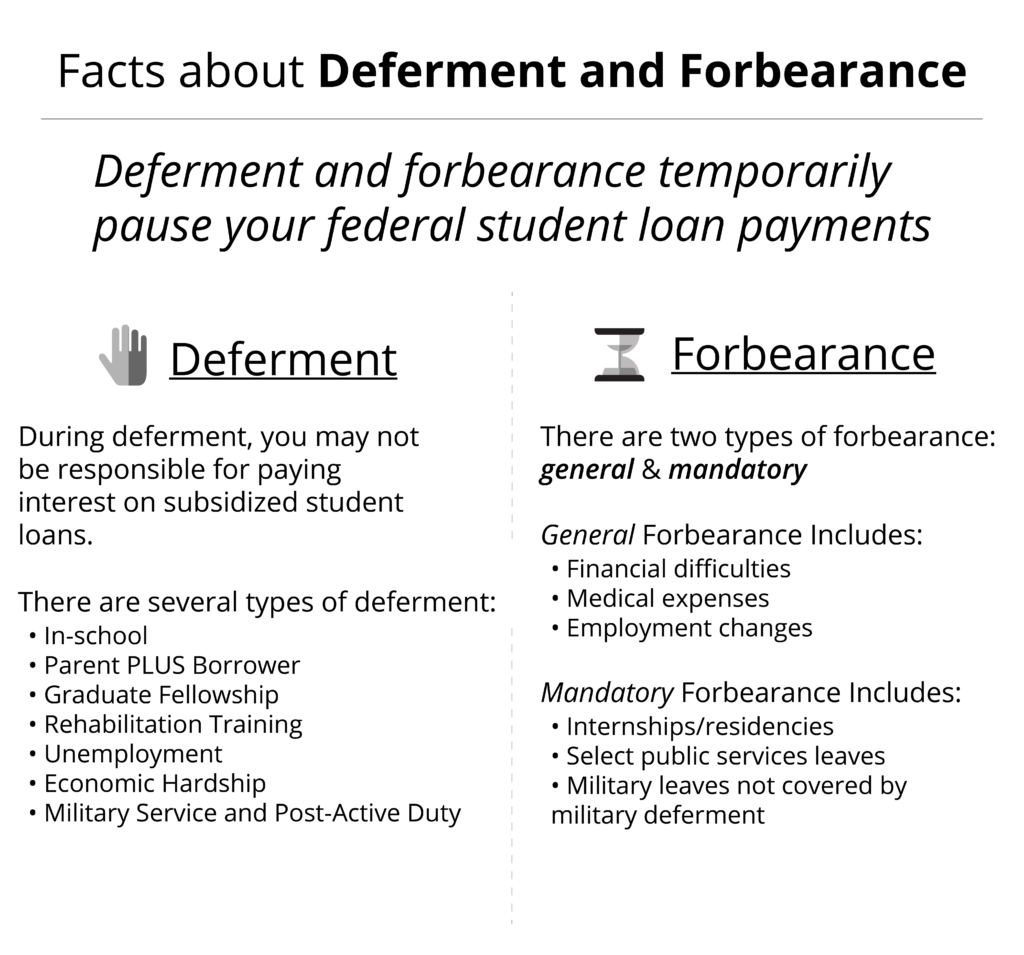

Forbearance

Forbearance is like deferring a student loan. The difference is that in forbearance, you always keep accruing interest.

Whereas in deferment, your interest may not keep accruing. Therefore, forbearance can be stopping payments altogether for a set time or lowering costs.

Employer Payment Programs

Sometimes an employer will have a program that helps their employees pay down their debt. Check with your employer to see if they offer this kind of program.

Refinancing

One way to help when times get tough is to refinance your student loan. If interest rates are lower than when you first received the loan, refinancing could lower your payments and lower your interest rate.

To Conclude

Student loan deferment is tricky. In some ways, it can help borrowers stay out of debt. In others, it can make it worse. Doing your research and consulting a loan officer can help you make an informed decision.

Leave a Reply