You’ve probably heard of an Emergency Fund, but have you heard of a Rainy Day Fund? They might sound very similar, but they are different.

Ideally, you want to have them both. This article will look at the difference and then give some tips for starting a Rainy Day Fund.

https://www.thebalance.com/do-you-need-a-rainy-day-fund-and-an-emergency-fund-4178821

Emergency Fund vs. Rainy Day Fund

The difference between an Emergency Fund and a Rainy Day Fund is in the amounts and goals for the money you need to save.

Emergency Fund

An Emergency Fund has the goal of keeping you afloat if you have a significant emergency or lose your job.

Typically, an Emergency Fund needs a minimum of three months of expenses. However, the recommended amount is six months to a year of costs.

Expenses include:

- Rent or mortgage payments

- Grocery and food bills

- Utility bills like electric, heat, gas, or water

- Credit card bills or other debt repayment bills

- Any other expenses you may have

You want to determine how much you spend every month on “Needs” and “Wants.”

Suppose you find that cutting your wants is hard, budget to include them in your emergency expenses.

If you do not have an emergency fund, it is a good idea to start funding it and your Rainy Day Fund. Follow the steps below for creating a Rainy Day Fund can also create an Emergency Fund.

Rainy Day Fund

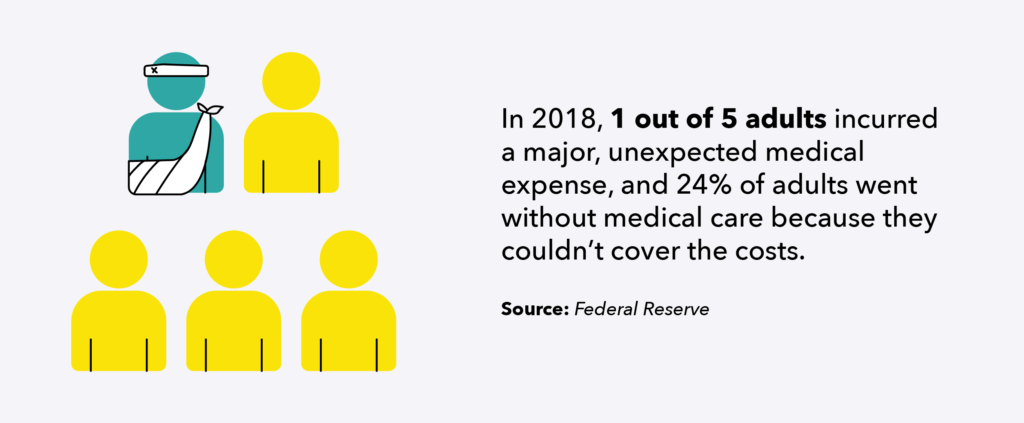

A Rainy Day Fund has the goal of getting you through surprise expenses. These expenses are usually one-offs and unexpected. Examples include:

- Car repairs

- Your Car needs to be replaced

- House floods due to plumbing or natural disaster (and insurance won’t cover it)

- Tree falls on your house and insurance won’t cover it

- You work from home on your computer, and it dies for good and needs to be replaced

- You get severely ill and need to pay medical expenses not covered by your insurance

Rainy Day Funds can be for any small expense that you do not have the money available for now.

It would help if you only broke into your Emergency Fund or Rainy Day Fund for needs, not wants.

Steps to Create and Fund Your Rainy Day Account

You can create and fund an Emergency Fund or a Rainy Day Fund with the following five steps. If you need to support both, put a little aside in two separate accounts each month.

1. Open a Dedicated Account

The first thing you need to do is open a dedicated account. Give it a name if your bank allows this. Make the name specific: Rainy Day Fund. You can create automatic deposits if you know the amount will not change month to month. However, if you have a little extra on any month, make sure to deposit that as well.

2. Budget

Look at your budget and spending. This is important for deciding how much to put in your Rainy Day Fund or Emergency Fund and determining how much you have available.

Questions to Ask Yourself:

- What are you spending money on?

- What things are “Needs” or things you need to live, work, be happy?

- What things are “Wants” or things you could go without for a while or could cut back on?

- Which “wants” are you willing to give up if you need to save more money?

- How much are you spending on each item?

- How much do you have leftover each month?

- How much are you putting away in retirement savings?

- How much debt do you have?

- How much are you paying off each month?

- How much money are you making each month?

Once you have all your numbers, you need to make a plan. Please stick to your plan, and whenever you have extra money on hand at the end of the month, make sure to move it over into your Rainy Day or Emergency Fund.

https://www.youneedabudget.com/rainy-day-fund-basics/

Start with What You have

First, it does not matter how little you must contribute so long as you try to contribute something.

You can start with $10 a month, $100 a month, or $500. You can start with $230 or $55. Deposit whatever is available for you.

Are you working with a variable income? Does it change each month? You can follow your budget and move whatever money is leftover and not needed for the next month into your fund on the last day of the month. Moreover, contribute more money in months when you make more money.

Take advantage of money gifts, inheritances, tax refunds, or any other surprise money that you do not need.

If contributing monthly doe not work, contribute weekly or biweekly, or bimonthly. Find a contribution schedule that works best for you.

Build a Habit

Make it a habit. Whatever contribution schedule works for you, make it a habit. Therefore, make your contributions whenever you sit down to work on money, such as balancing your checkbook.

Schedule time in your calendar to look at your income, expenses, and budget and adjust as needed.

Furthermore, It would help if you did this at least every couple of months. If you work in a job with a variable income, you should schedule this at least once a month.

Adjust

This last step is critical. Adjust your contributions whenever necessary. Additionally, whether you must contribute less due to life circumstances or more due to an increase in income, make sure to adjust your contributions.

Do not worry that contributing less will make it take longer. Remember that any contribution is better than no contribution.

Leave a Reply