Inflation is often a thing that people hate to hear on economic news. That’s not a surprising reaction since inflation brings higher prices for goods and services.

After its all-time low last year, inflation (and the interest rates) is starting to gain momentum once again. Should the public be worried about this development?

What Is Inflation?

According to Investopedia, inflation is the fancy term used when measuring the rate of the price increase.

This price increase measures both goods and services. Inflation usually happens when the demand for certain products increases, but the supply stays the same (or has been decreased.)

As a result, people are willing to pay more for the products or services that they want.

With this in mind, the companies and manufacturers will likely get profits. This is only a natural effect that happens during shortage supply.

There are signs of inflation in some industries already.

- For example, steel manufacturers are selling their products to the highest bidder.

- Tech products and parts are costly due to the shortages and restrictions in manufacturing.

How Does COVID-19 Affect the Inflation Rate?

COVID-19 affected a lot of business operations last year. Hence, there are tons of businesses, especially the local ones, that needed to close or temporarily stop their operations.

This caused a massive increase in the unemployment rate. People are forced to be conservative in their spendings and instead saved their money, which caused all-time low interest rates.

As the pre-pandemic “normalcy” returns, however, these businesses will be able to operate exactly as they do before. To cope with the pandemic’, most goods and services are expected to increase prices.

What if numerous people suddenly started to spend money while the supply is still low? The prices of goods and services will likely skyrocket.

This is especially predicted in industries like tourism, clothing essentials, movies, traveling, and more. Once the pandemic restriction is lifted, you can expect people to try and enjoy their new-found freedom.

Possible Biggest Contributors of Inflation

1. Increasing Personal Income

One of the most significant factors that might or might not cause inflation is the increase in personal income.

Since people have spent their time working at home, an increase in personal income is expected. This is especially true when it comes to cases wherein there is a lucrative source of income available.

https://www.politico.com/newsletters/morning-money/2021/01/27/should-we-worry-about-inflation-793002

For example, your phone had given up during the pandemic. However, since the manufacturing of phones had halted, you don’t have any means of buying a new one, even if you can.

Once the phone manufacturing is resumed, you will likely get a new phone, regardless of whether the price is too high compared to the pre-pandemic level.

Stimulus checks are one of the possible factors that can speed up the rise of prices since most people have money saved for spending.

2. Restricted Supply

Even if all businesses start to operate today, there are still COVID-19 restrictions implemented in most areas.

The supply for certain products and services will stay at a restricted level, affecting the production cost and products’ price. As long as the supply is low, you need to accept the possibility of inflation.

3. Resumption of Normal Business Operations

Once the businesses resume their operations, they will try to cash income or revenue immediately.

The year before had been draining their resources and depriving them of sales or income. Some in-demand industries are likely going to raise their prices.

4. The Efficacy and Proper Distribution of Vaccines

In all honesty, this is not a bad thing, considering how people and businesses want this medical emergency to stop already. But the faster you can return “normalcy,” the quicker you might end up with inflation.

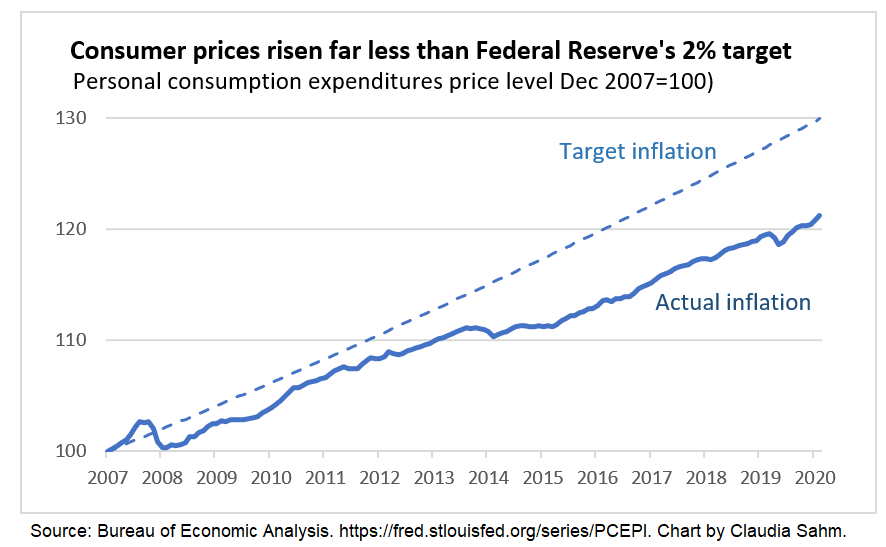

It might not sound great from an economic perspective, but that’s not the case. According to the Federal Reserve, low inflation might cause a bigger problem.

What Does the Fed Say?

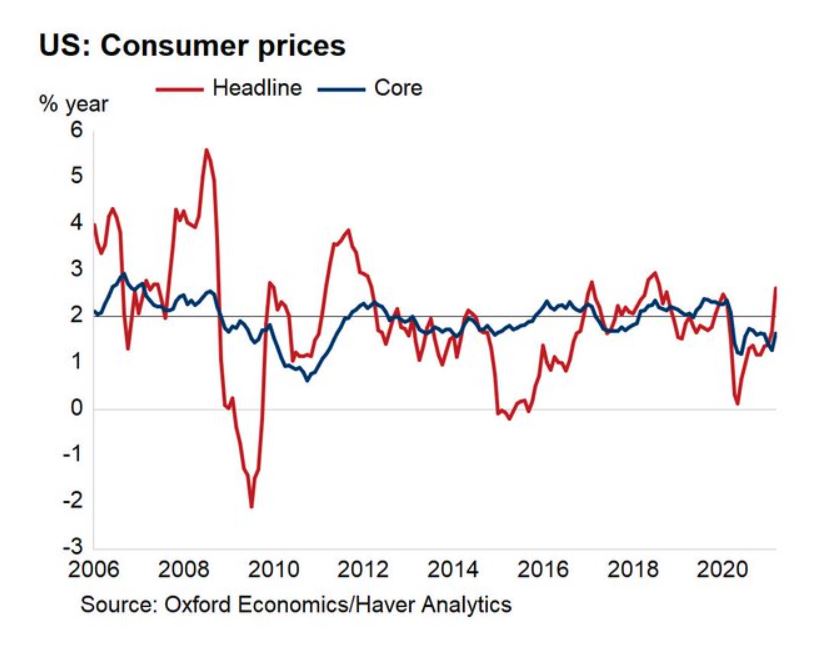

The Federal Reserve, or the Fed, actually expects an increase in the inflation rate this year. According to Fed Governor Lael Brainard, the inflation rate is expected to rise temporarily.

Brainard added that the inflation rate might even reach above 2% after March or April. These are the last months in which a 12-month calculator finally ends.

Pre-Pandemic vs. 2021 Levels

Take note that there are policies implemented which caused a downtrend motion in both the interest and inflation rate.

These policies were implemented to stimulate economic activity in the country. Low inflation means that the economy is stagnant and that there is no improvement happening in an area.

The Federal Reserve explained how this spurt of growth in the inflation rate is just the economy healing itself from the damages it got since the start of the pandemic.

https://www.bloomberg.com/opinion/articles/2021-02-10/inflation-is-a-risk-four-more-reasons-to-worry

It is just returning to its pre-pandemic levels. People will soon start to reenter the workforce, resulting in more purchasing power as the supply of goods and services stabilizes.

Should We Be Worried?

The short answer is no since a lower inflation rate might hurt more than higher inflation. It means that businesses are likely not able to recover and that people will stay jobless if the low inflation continues. There is a long-term plan for inflation, and it seems like we’re still on track with this goal.

However, if you’re one of the people who plan to refinance your mortgages or a potential real estate investor, you might have to be wary about the changes caused by inflation.

Higher inflation means a higher interest rate, which makes mortgages more expensive.

Leave a Reply