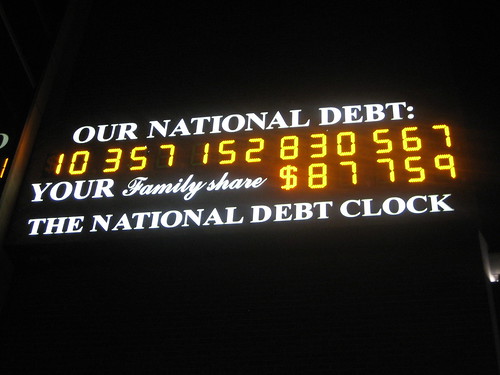

photo credit: Kevin Krejci

Assuming you are investing for future retirement, you should seriously consider the Roth IRA (Individual Retirement Agreement). I am already a huge fan of the Roth, but as the national debt increases with federal bailouts and stimulus packages, the Roth IRA is looking better all of the time.

Let me explain. With the traditional IRA, you get to deduct the contribution for the tax year it was made, but you will pay taxes when you start drawing the money out for retirement. The Roth IRA, on the other hand, is purchased after you have paid your taxes and is therefore tax free when withdrawn. When deciding which one is best for you, conventional wisdom is that if you believe you will be in a lower tax bracket when you retire, you are better off with the traditional IRA. Why? Because you were able to claim a tax deduction at a higher percentage, but pay those taxes later at a lower percentage.

But I ask: do you seriously believe that the tax structure when you retire will be essentially the same as it is today? Is it possible that even if your retirement income is less than your working income, your tax rate could be higher than it is today?

Why The Roth IRA is a Good Choice

Our current national debt is $10 trillion and climbing by the second. My longhand math (calculators don’t have that many zeroes) indicates that we owe $30,000 for every man, woman and child in America. To compound the problem, the Social Security Trust Fund is scheduled for depletion in about 30 years unless “something” is done. That “something” will have to be raising taxes or lowering benefits. As I see it, Congress has four possible choices:

- We could spend less than we make. A great choice, but nowhere on the radar.

- We could print more money, but doing so will raise inflation rates, maybe to hyperinflation. Not a good choice.

- We could sell more Treasury Bonds, but our national debt is making these bonds more and more risky. Besides, neither families or nations can borrow their way out of debt.

- We can raise taxes. Again, not a good choice, but, in my mind, one that will happen.

Our future tax structure is very uncertain because of our national crash course with debt. Are higher income taxes a certainty? No, but in my thinking a very high probability. Although I am already retirement age, I invest in a Roth IRA every month. I just feel better about paying my taxes today, knowing that they are fully paid today and will never be impacted by future tax increases. That, for me, is a very good feeling.

Update: Consumer Boomer did an excellent job recapping all the Roth IRA limits. Be sure to check it out.

Leave a Reply