There are multiple strategies for repaying debts, and which one is the best for you will depend on what you view as most important.

The most important things to consider are:

- Keeping morale up,

- Saving money, and

- Ensuring the plans will work.

We will examine why you may need a debt repayment strategy, learn about four of them, and explore why you should or should not use them.

Why do you need a debt repayment strategy?

If you are used to simply paying your bills at the end of the month and only paying the minimum payment, you might find your debts dragging on for much longer than needed.

The solution is to voluntarily overpay to reduce the amount you are paying on interest every month. But you will need a way to decide where these over payments go.

If you cannot do overpayments, you may still need a debt repayment strategy for managing your required monthly payments, either because they are too many to keep track of or too expensive.

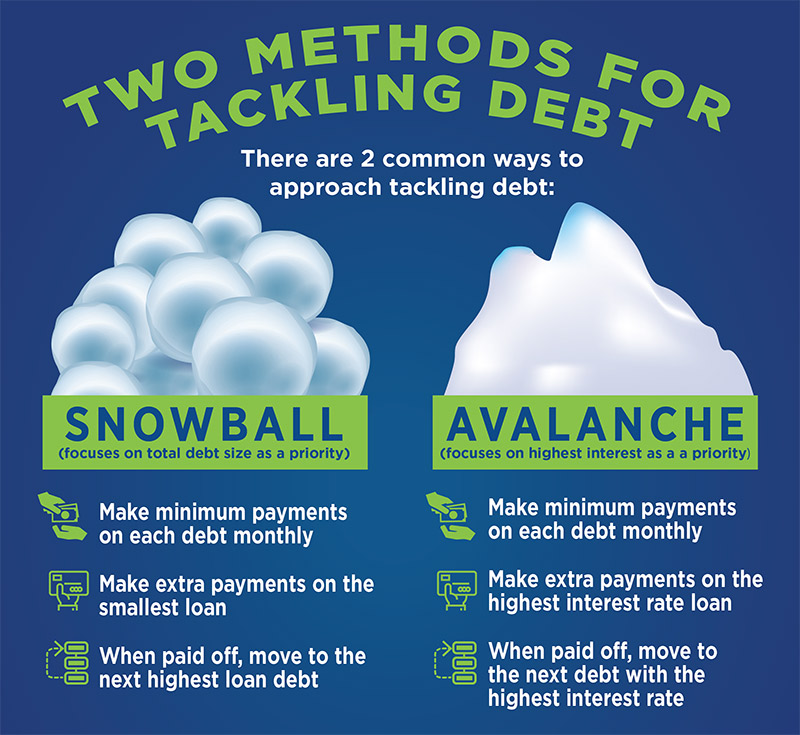

Debt snowball

The debt snowball strategy of repaying multiple debts starts by looking at all of the debts you owe and sorting them from the smallest balance to the largest. Once you have this sorted list, all money you plan to put toward paying off your debts will go to the one with the smallest balance.

This smallest debt will be the fastest to pay off, and once you have paid it off, you will put all your repayment money into the new smallest one.

Because you are always paying off whichever debt is the fastest one to do so, this strategy will reduce the total number of debts most quickly.

Reasons For

The debt snowball method will get you fast victories. This strategy is designed to be unbeatable in stacking up many achievements early.

If you are feeling overwhelmed by your debts or demotivated at how they never seem to end, these early wins can be an absolute game-changer at putting you back on your feet and in the fight.

Reasons Against

The debt snowball strategy is not the best to use from a mathematical perspective.

Because you are not factoring in the varying APRs, unless you are lucky, you will almost certainly end up paying more interest and therefore losing more money in the long run.

The debt snowball strategy’s psychological benefits may not work for everyone. For example, if you focus more on efficiency than symbolism, you may even be demoralized when you see high-interest levels lasting longer than needed.

Debt avalanche

Like the debt snowball strategy, you will also focus all your repayments on one debt at a time, but with debt avalanches, this focus is always on the debt with the highest interest rate.

Reasons For

The debt avalanche strategy is the right choice if your finances are unstable or you want to save as much money as possible.

Because you will eliminate the highest interest rates first, the amount you will be paying on interest every month will go down the fastest way possible. Therefore, the total amount of money you will have spent on interest once all your debts have been paid off will be lower.

In practice, the debt avalanche strategy is the fastest way to reduce your total debt, including interest, even if it does not necessarily reduce the number of individual debts as quickly.

Reasons Against

If you are prone to distress, lack of motivation, or struggle to cope, the debt avalanche strategy can be highly demoralizing, especially if your highest-interest debts are among your largest.

For this reason, the debt avalanche method should not be used if you are not very disciplined.

If you lose morale, which can hurt your income, you could get deeper into debt, which would cancel out any mathematical advantage this strategy might have.

Debt consolidation

If you have multiple debts, a straightforward solution is to take out a loan that covers the balance of all of them and use it to pay them off.

By doing so, you effectively combine several debts into a single debt. Because there is no guarantee of what loans you could have access to, everyone’s mileage will vary with this strategy.

Reasons For

Debt consolidation makes repaying your debts a lot more simply because you only have to keep track of one payment instead of many.

If you have a good credit score and can get a big enough loan with a low enough APR, this strategy can also lower your monthly interest payments, possibly by a lot, saving you money in the short and long term.

Reasons Against

If you have a low credit score, you might not have access to a loan that would benefit from this strategy. The APR will be too high or the amount available will not be enough to consolidate all your existing debt.

This can make the search time-consuming and frustrating and may not even give you a positive result.

Debt management plan

The most extreme strategy for repaying your debts is to enter a debt management plan with a consumer credit counseling agency.

The agencies set up and run these plans. They will take your one monthly payment and give it to your creditors themselves.

Reasons For

The agencies will often be able to negotiate your payments so that you are paying less every month. If you struggle to make ends meet, this can be critical to keeping your household afloat. It will also be easier to keep up with your debt repayments because there will only be one to make each month.

Reasons Against

You will not be able to pay for anything using your credit cards while on a debt management plan. This can be a deal-breaker if you rely on them for many essential payments.

Final thoughts

We have learned about four debt repayment strategies and the positive and negative aspects of using each, so you are now ready to choose the best one for your personal needs.

Leave a Reply