When Janice and I became gazelle intense about getting out of debt, we did so hook, line and sinker. Once we paid our credit cards off, we either quit using them or cancelled them. Over the years, I have sporadically checked my credit report, but had never become curious enough to obtain my official credit […]

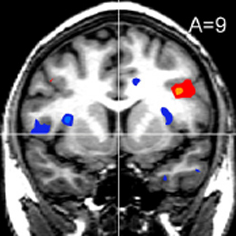

Do We Spend More With Credit Cards? A Study Proves … Maybe

Do people really spend more with credit cards than with cash? This topic has been beaten until blue and there seems to be no documented study which proves one way or another. Yes, many of us have heard of the Dunn and Bradstreet study (oft quoted by Dave Ramsey) that indicates people spend 12-18% more […]

How Minimum Credit Card Payments Will Keep You in Debt Forever

Did you know that making your minimum credit card payment every month will take you as much as four times longer to get rid of debt than making a fixed payment? I recently ran across a nifty calculator at Bankrate.com that I recommend looking at. When I plugged in $5,000 debt at 12% interest with […]

Expect Rate Hikes Even After the New Credit Card Act Takes Effect

photo credit: TheTruthAbout… The major changes required by the Credit Card Act of 2009 will kick in on February 22. But just because Congress has tried to stifle the less than stellar side of the credit card industry, don’t think for a moment that banks have been sitting on their heels. Here’s how the new […]

Credit Card Alert: Read the Fine Print

photo credit: xJasonRogersx Credit card legislation and new Federal Reserve rules which passed last year are consumer friendly, but don’t expect credit card companies to make things easy for their customers. Some of the changes have already gone into effect, but the majority of the them will take effect on February 22, with more scheduled […]