There are several tricks that you can use to save. Some set automatic deposits to a savings account, for instance.

Others might divide their paycheck up into labeled envelopes to keep track of spending. This works for some people, but not everyone… and that’s where the Digit Mobile App finds its niche. So, does the app meet up to all of the hype?

What Is the Digit Mobile App?

In 2013, San Francisco-based developer ‘Bloch’ launched the Hello Digit mobile app. Designed with the task of automating finances, the app is geared towards simplifying the process of saving money.

This is a ripe market, statistically, at least 45% of bank account holders don’t have any savings to speak of.

Best of all, the project was funded by Google Ventures and Baseline Ventures to the tune of $2.5 billion.

https://www.doughroller.net/personal-finance/digit-review/

Considering the amount of seed money that went into this project, we should expect some results. So, what exactly can the Digit Mobile app do?

How Does Digit Save Me Money?

As it turns out, Digit can do quite a lot. The way that it works is that Digit analyzes your spending patterns to determine how much you can comfortably save. Described as a “micro savings platform”, it’s quite good at what it does.

One of the ways that it works is that it makes tiny withdrawals, sneaking them over to your savings and keeping the amounts small enough that you might not even notice.

Over time, these can build up, but Digit does quite a bit more than this. Here are some of the key features that come with Digit:

- Automated Savings – This is the main feature, of course, but it’s not just about micro withdrawals. Digit can target these savings towards your goals and even retirement!

- No account minimum required – Anyone can use Digit. The app is designed with people who cannot save in mind. So, if your account could use a little growing then Digit is designed for you!

- Automated debt management – Digit can be set to automatically pay your credit cards and other bills.

- Overdraft reimbursement – This is a very cool feature. If your account dips below a certain level, Digit will automatically move funds to the account to protect you from overdrafts. If you still get an overdraft, Digit will reimburse you up to 2 times.

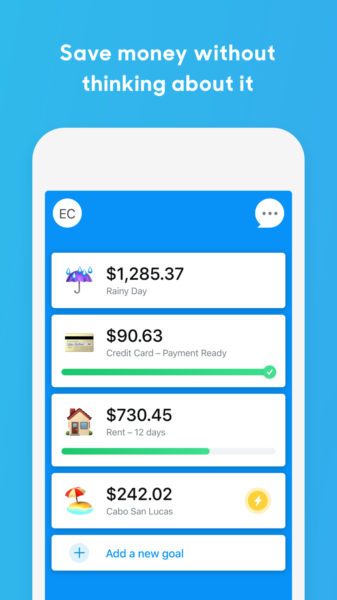

- Goals – Are you saving up for some electronics that you want? Maybe there is a concert coming up that you want to see and save for or maybe you simply want to make an emergency fund. Digit lets you set as many saving goals as you want. Then, it will slowly fund all of them. Giving you more control over the financial profile that you want to build for yourself.

- Savings bonuses – By saving with Digit for 3 consecutive months, you can qualify for a .10% savings bonus.

Digit Can Help You Save for Retirement

Digit has been well-received and its increased popularity, which has led to additional product offerings. With Digit, you can now open an Investment Account or a Digit Retirement IRA.

The contributions are made on the same date monthly. You can use their “Boost” option to increase the number of contributions.

Is Digit Secure?

One of the perks of such a well-funded app is that Digit may be used with confidence.

By encrypting your data and anonymizing it, transactions are quite secure to the point that your account is FDIC insured for up to $250,000. This insurance gives Digit the legitimacy to be seen as a serious tool and subsequently, a safe one to use.

What Does It Cost?

Okay, so it sounds great, but what does it cost? Digit is free for you to try for 30 days, but if you decide to keep it, the cost is pretty fair.

Digit costs $5.00 a month to use but there are withdrawal charges if you need an ‘instant’ withdrawal from your account.

https://dollarsprout.com/digit-review/

An instant withdrawal to your external account will cost .99 cents per transaction. If you don’t need the money right away, however, a standard withdrawal only takes 1 to 2 business days to reach your account. This type of withdrawal is free.

Considering the .10% savings bonus that they pay you, the app pretty much pays for itself, especially if it can start building your savings where other methods have failed.

In Summary

If you are like most of us and have trouble deciding how much to put into savings, Digit can be a game-changer. It’s FDIC insured, extremely well-funded, and it analyzes your spending to allocate every extra dollar.

The algorithms employed by Digit can put that money to work and the popularity of the app seems to indicate that it’s not only working but that its clients are spreading the word.

So, why not give it a try? You can get 30 days for free and if it doesn’t impress you, simply delete it and forget it.

We have a feeling, however, that you might just be in for a very pleasant surprise!

Leave a Reply