There are many kinds of life insurance products available on today’s market. One of the more popular ones is universal life insurance.

While universal life insurance is a recognizable type of insurance, not many people know much about it.

What is universal life insurance?

Universal life insurance is insurance that you pay throughout your life. It’s a permanent insurance policy where you pay premiums every year.

A universal life insurance policy covers you as the insured person for the rest of your life as long as you continue paying the premiums (be it monthly, quarterly, or yearly).

Aside from the premiums, you also need to keep up with other requirements that are asked in the policy to keep it active and continue covering you.

Universal life insurance policies also have a built-in savings component, which is similar to most permanent life insurance policies.

This savings component is also known as a cash value, that’s why universal life insurance is also known as “cash value insurance.”

What are the advantages of universal life insurance?

There are several benefits to purchasing a universal life policy.

Get Money from Your Policy

The premiums you pay on your universal life insurance policy get divided into portions.

- One portion is used to pay towards your death benefit.

- Another portion is allocated to establishing and growing the cash value of your policy.

When the cash value of your policy has reached a certain level, you will be allowed to withdraw it or you can borrow money based on the policy’s cash value.

Most people choose to pay the maximum payments during the start of their policy coverage so they can amass a higher cash value earlier. The money accrued from the higher cash value is then used to pay for the premiums as the policy matures.

Different insurance companies will have different rules on borrowing or withdrawals, so there’s no standard process.

It should be worth noting that withdrawals or borrowing money against the policy’s cash value could also mean that it can affect the total amount you get from the death benefit.

Other consequences include taxes that will be imposed on you and your policy lapsing.

The Policy Earns Interest

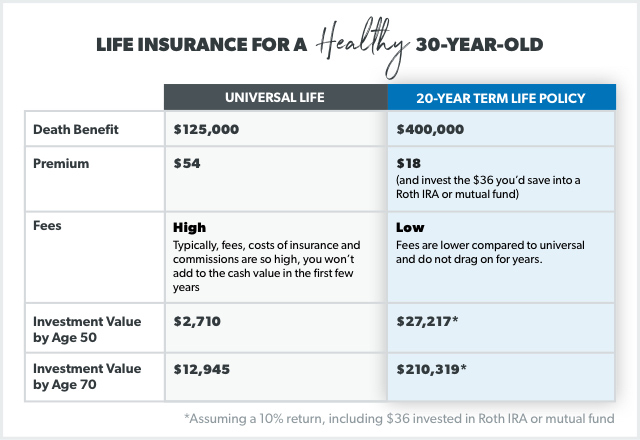

A universal life insurance policy has a cash value that earns money through interest. The interest rate is dictated by the prevailing rates in the money market. This means the rate can also go down.

Should I buy a universal life policy?

You may ask yourself, “Should I buy universal life insurance?” According to finance experts, it may be a good idea.

These are some of the reasons why.

You Have Ambitious Savings Goals

Universal life insurance is a wise choice if you are planning far ahead into the future.

Universal life insurance allows you to keep saving with some level of protection because making withdrawals or borrowing against the cash value is not easy.

This wall of protection makes it a truly attractive option for people who want to save without being tempted to use the money.

You’re Looking for Total Coverage

If you are a diligent payer of your premiums, you will be covered for the rest of your life. And when you do pass away, no matter when, your beneficiaries will get your death benefit.

You Can Adjust Your Coverage at Any Time

Another reason you should buy universal life insurance is the flexibility it gives you as the policyholder.

You can modify the face value of your universal life insurance and you won’t need to give up your policy to do so.

What this means is that you can modify your premiums at any time. You can increase your premiums, lessen it, or even stop it.

This is a wonderful option to have especially with life being uncertain. There may come a time when you will be hard up financially. When this happens, you can ask to lower your premiums.

https://www.policygenius.com/life-insurance/universal-life-insurance/

Same when you have a windfall or earning more – you can ask to increase your premiums to gain more financial benefits.

Universal life insurance is an intelligent choice if you are looking for an insurance instrument that gives you ample coverage but also gives you the ability to save.

These are wonderful benefits to have especially if you have a family you want to take care of in the event anything happens to you.

If you plan to get universal life insurance just make sure that you talk to a good insurance agent who can answer all your questions and guide you through the whole process of getting a policy.

Leave a Reply