According to a recent study by USA Today, the average couple can expect to spend over $300,000 on healthcare in retirement. While many think their cost of living will decrease in retirement, prices often increase. Having an HSA or FSA can help with significant medical expenses. A health savings account can also benefit your loved one’s medical bills.

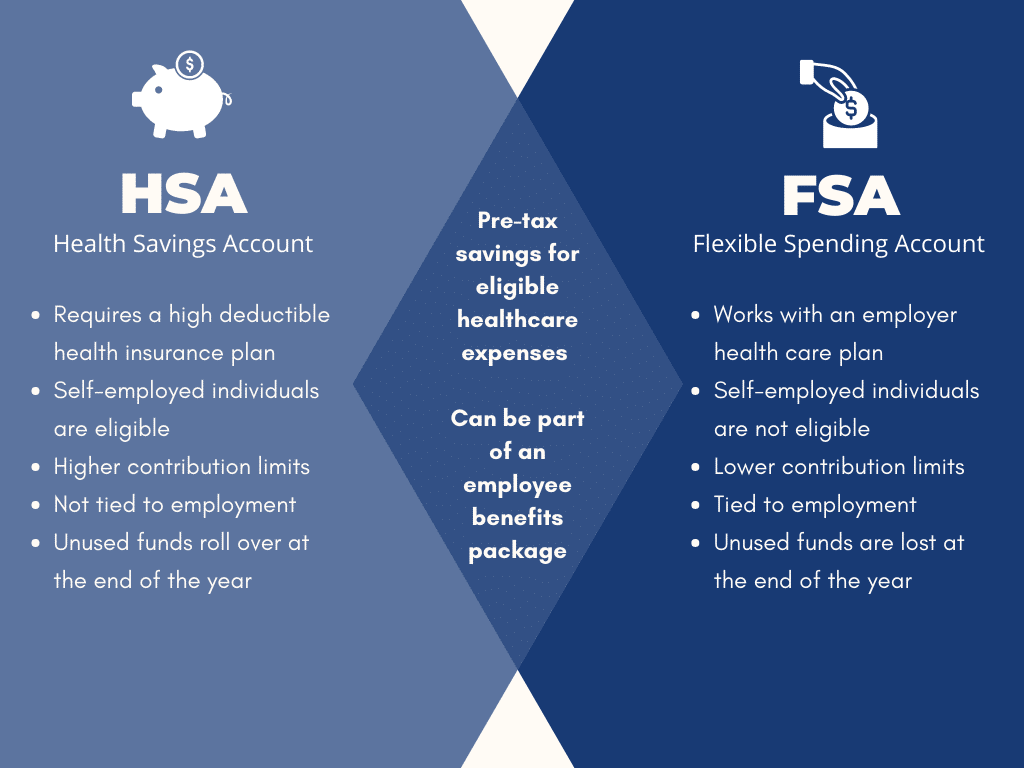

The big difference between an FSA (Flexible Spending Account) and an HSA (Health Savings Account) is that you control an HSA and rollover contributions into the following year.

At the same time, FSAs are handled by your employer and don’t offer the same flexibility. So, if you like being in control of your medical savings for the future, you may want to consider the pros and cons of an HSA.

The benefit of having an FSA or HSA

A health savings account allows you to save pretax funds to cover qualifying medical costs. To be eligible, you need a high-deductible health plan or HDHP that qualifies for an HSA.

This money is held by the HSA trustee, which can be a bank, credit union, or another type of financial institution) until you withdraw it to pay for some types of medical expenses.

According to IRS policies for 2022, a health insurance plan is an HDHP if it offers:

- Individual minimum deductible of at least $1,400 and $2,800 for a family plan

- Individual coverage includes a maximum of $7,050 for out-of-pocket payments and family coverage with max personal payments of $14,000

HSA eligibility requirements also include not being listed as a dependent on another person’s tax return and not being enrolled in Medicare.

Remember that an HSA is more flexible than an FSA, since your employer doesn’t own it. With an HSA, you can better regulate your contributions and access your benefits.

However, an FSA is a valuable option for people who do not want to set up a healthcare account or would prefer to let their employer handle the contribution details.

So, how do these plans work?

Here’s how a health saving accounts work

It is a good idea to check with your insurance company or employer if you are unsure whether your health plan qualifies as an HDHP.

Get all the details: interest rates, investment options, fees, and any extra services can vary from trustee to trustee. For example, some institutions offer fund transfers between your bank accounts and HSA accounts to help make bill-paying easier. Some also let you store your medical receipts electronically for better tracking.

- In 2022, you can contribute up to $3,650 to your HSA account per individual and $7,300 to cover your family.

- In addition, if you turn 55 by the end of the tax year, you can contribute an extra $1,000 with a catchup policy.

If you choose to deduct your HSA contributions from each paycheck, the amount you contribute will decrease your taxable income.

The good news is that any interest you accrue in your HSA account is not subject to taxation. This means you can allow your money for future medical expenses to grow tax-free. In addition, your employer will not withhold taxes on HSA contributions, which can help lower your tax bill.

You will not get taxed on any money withdrawn from an HSA if you use it for qualified medical costs. This includes a long list of vision care, prescription drugs, psychiatric care, dental care, copays, and any other type of eligible medical care that isn’t covered by your health insurance plan.

One big bonus is that your HSA funds will never expire. You can leave it in the account forever. In addition, you do not need to spend it in any given year since HAS funds roll over at the end of the year. This contrasts with FSAs, which require you to use or lose your funds that year.

Once you reach a high enough account balance, most trustee institutions will let you invest HSA money in stocks, bonds, or mutual funds. The next covers all the cons of having an HSA.

The cons of using a Health Savings Account

Here are some not so great benefits for an HSA:

Early Withdrawals

If you withdraw funds from an HSA before age 65 to cover non-medical costs, the IRS considers this taxable income and will charge a 20% penalty.

Keep receipts for any HSA payments in case the IRS chooses to audit your HSA account.

Contribution Timing

Specific tax penalties can apply to your account if you apply for Social Security and do not stop contributions at least six months before applying.

Not 100% Eligibility

One downside to using an HSA is that if you are on Medicare or claimed as dependent on someone else’s tax return, you will not qualify for an HSA.

High-Deductible Health Plans Only (HDHP)

If you do not have an HDHP, you will not be able to use an HSA.

HSA Card Rejection

It’s good to know that not all stores will take HSA debit cards, so be aware that you might sometimes need to pay out of pocket and get reimbursed by your HSA institution.

End of Contributions

Once you reach age 56, which is the age when people can apply for Medicare, you cannot add any contributions, including catchups, to an HSA even if you are still employed.

Now it is time to look at the benefits of getting an HSA for you and your family.

The top 10 benefits of having a Health Savings Account

Here are the pros for this account type:

1. Tax Advantages

Compared to 401(k) accounts, HSAs offer more tax benefits such as pre-tax funds, employer or relative contributions, untaxed withdrawals for eligible medical expenses, and tax-deductible benefits, even if you’re unemployed, non-taxed interest averaging about 0.01%, and investment opportunities.

2. No Deposit to Open

Most HSAs do not require a minimum deposit to open an account.

3. Balances Can Roll Over

Unlike an FSA, where there’s a “use it or lose it” policy each year, HSA balances roll forward yearly.

You will not need to worry about spending your funds at a specific time.

4. HSAs are Portable

An HSA is portable. This means that you, not your employer, own the account. If you leave your job, your HSA travels with you. Since an HSA is a bank account with your name, you can control when and how you use the money even if you change your health insurance plan.

5. HSAs Are Eligible to Be Insured

For people concerned about losing money put into an HSA, the good news is that HSAs are held by FDIC-insured banks or credit unions, insured for up to $250,000 per person per account.

6. Other People Can Contribute

Worried you cannot contribute as much as you’d like to your future health savings? With an HSA, you aren’t the only one who can put money in the account. Friends, family, or even your employer can fund your account.

However, the IRS does limit how much people can add to the account.

7. HSAs Carry Family Benefits

If you have a family, you already know that healthcare for everyone can add up. That is why an HSA can offer a good option for your spouse and dependent children if they’re not covered under your high-deductible health plan.

8. They Can Pay for Medicare Premiums

Once you retire, you can use HSA funds to cover premiums for Medicare or Medicare Advantage plans. At the same time, an HSA can’t pay for Medigap policies.

9. It’s Easy to Transfer Funds

Since an HSA is a particular bank account, the format makes it easy to transfer funds between your accounts to cover expenses.

10. Many Eligible Types of Expenses

An HSA can offer real benefits for people since they pay for a broad range of coverage, including medical care, dental treatment, and mental health services. You can check out specific expenses under the IRS Publication 502 section on Medical and Dental Expenses.

Eligible expenses include various medical, dental, and mental health services. They are explained in detail in IRS Publication 502, Medical and Dental Expenses.

Leave a Reply