photo credit: Matt McGee

These past three posts have walked you though the process of getting your budget up and running. I pointed out the five pitfalls you will need to avoid, the four benefits of a successful budget and five steps to putting the budget in place. You have listened and you are making it work and telling your money what to do. Congratulations! Your life will never be the same!

But after putting so much energy into the details you may be wondering, “What now? Am I simply going to be a numbers nerd the rest of my life, or is there more meaning to all this?” Great question! Allow me to help you see the big picture of where your life is headed. Gaining control of your money is going to allow you to focus on your financial goals, and will progressively give you more and more cash flow. So stop, take a deep breath and ask yourself, “What should I be doing with this cash flow?”

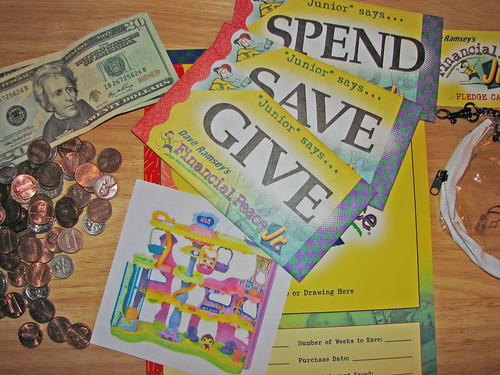

How did you answer? Janice and I have discovered that our budget allows us to SAVE, SPEND, and GIVE.

1. SAVE.

You will have something “normal” Americans don’t have: disposable income. What will you save for? In our case, we save for the basics: retirement, kids’ college, cars, remodeling our home and vacations (or staycations). You get the idea…basically everything. Don’t borrow your way back into debt; save!

2. SPEND.

You have done well. It is perfectly all right for you to spend money that you have saved. Enjoy! Go out to eat more often. Pay cash for that dining room set you have been salivating over. As you may have read in another recent post, we just bought an old “project” camper with cash we had saved. We can afford to refurbish it (a little at a time) with saved money. The point is this: your budget allows you to spend money you couldn’t have otherwise. You are not meant to live a pauper’s life.

3. GIVE.

If all we ever did was save and spend, life would become pretty empty. We are not here on earth to simply satisfy our own pleasures. But because generosity, for most of us, doesn’t happen spontaneously, we need to budget it. Whether you give to your favorite charity, your church, or the single mom down the street who could use some new tires for her car, it is this element in your budget that will truly make your life meaningful and satisfying. In addition to our church tithe, Janice and I set aside (budget) a little cash every month simply for blessing other people. If you do everything else right and never give, then, in my opinion, you have failed. GIVE!

Readers: What hinders your budget process? In what ways does your budget allow you to save, spend and give?

Leave a Reply