Believe it or not, tax season is upon us. Taking your time to prepare all your tax documents and review your financial situation from the previous year is one of the best ways to ensure you do not rush to collect everything you need to submit the night before the tax filing deadline.

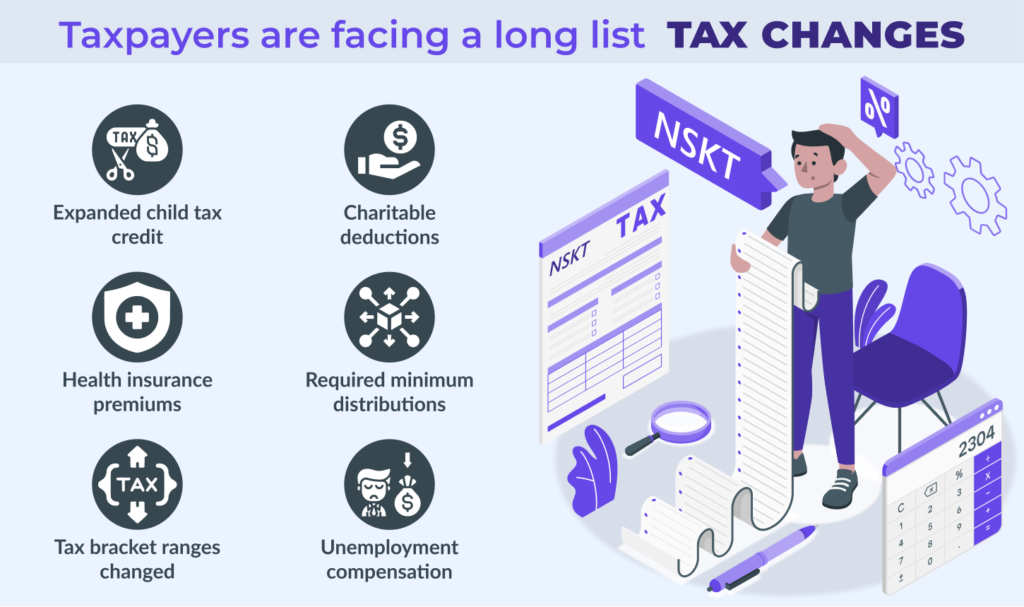

Another way to avoid a stressful tax season is to educate yourself regarding any significant changes that might impact your tax return.

The tax deadline is different this year

This year, people will have a couple of extra days to file their taxes. This is because Emancipation Day, generally observed on April 16th, will be celebrated on April 15th as the 16th is on a Saturday.

Thus, you will have until Monday, April 18th, to file your taxes this year.

Retirement savings

If you have a retirement savings plan that your employer sponsors, you might be able to boost your savings starting this year.

There has been an adjustment to how much one can contribute to their employer-sponsored savings plan if they are 50 years old or more.

The previous limit was $20,500, but it has been increased to $27,000 for eligible taxpayers. If your employer matches your contributions, it’s worth taking advantage of this increase.

Child tax credit payments

In 2021, the monthly child tax credit was launched for qualified Americans. These amounts must be reported as income on your tax return, meaning it could impact your potential refund or amount owing.

Taxpayers who received the monthly child tax credit will be mailed a letter reminding them of the amount they must report on their tax returns.

The Recovery Rebate Tax Credit

If you did not receive the third installment of the stimulus payment or didn’t end up receiving the full payment, you might potentially qualify for the recovery rebate tax credit.

There will be letters sent to recipients to remind them of what they received for their third stimulus payment.

It is essential to keep this documentation that the IRS sends to you for people who qualify. You will need it to prove you are, in fact, eligible for the recovery rebate tax credit.

Changes to Social Security

Some people will be pleasantly surprised to learn that their Social Security benefits will be going up a little bit. However, those who see that increase should be aware that, when tax time comes, they might have to pay a little more tax as their income has increased.

Whether or how this Social Security increase could impact your potential tax situation will depend on your situation, including what kinds of tax write-offs or benefits you are entitled to claim. If you are not sure how to manage the potential tax implications of this income increase, it is a good idea to chat with an accountant.

Charitable donations

If you made some charitable donations in 2021, you might see more of a benefit from them in terms of your tax deductions. However, it should be noted that these changes are only valid for the 2021 tax year as of right now.

You can deduct $300 in cash donations from your taxes or $600 if you file as a married couple. Furthermore, the way you can claim charitable donations has changed slightly. You can either itemize your charitable donations or take a standard deduction.

Taxpayers can potentially opt into some tax benefits for those who donate a lot of money. Instead of deducting your charitable donations from only 60% of your adjusted gross income, you could potentially deduct them from up to 100% of your adjusted gross income. However, you must itemize your donations to approved organizations and opt for this option to benefit from it.

Consider speaking with an accountant this year

If you do not understand tax legislation very well, it may be worth speaking with an accountant before filing your taxes this year.

The pandemic has changed the economy and our incomes so much in the last two years, meaning that some might be filing taxes differently for the first time this year.

Leave a Reply