With the end of the year approaching, it is time to conduct a year-end financial review. This will help you better understand where you are doing well and what needs improvement. It can also help you prepare for the year ahead.

You may think that conducting a year-end review is a waste of time, but it is not.

Instead, it will help you get organized for next year and keep your finances on track so that you are ready to go when it comes time for tax season.

Be Organized

Make an inventory of your assets and liabilities (you can use Excel or Google Sheets for this).

Be sure to include all of your investments, bank accounts, retirement accounts, credit card accounts, loans, and mortgages—and any other major assets or debts that might affect how much money you have available each month.

Separate Your Assets

Please review all of the transactions from this past year and categorize them according to expense type (rent/mortgage payments, groceries, utilities, etc.).

Then add up these categories individually, so you know exactly how much money went toward each expense type throughout the entire year (the total sum).

Look at the Positive

If conducting a financial review fills your heart with dread, you can get over this hurdle by starting your review by looking at the positive.

You may have grown your savings account, invested more money in stocks or bonds, taken on a new hobby like knitting or photography—or maybe even started a business.

Whatever has happened, it is essential to take stock of all these things and look at what worked for you financially this year.

Mark Your Accomplishments

Have you made any big purchases? Did you do anything special with your money? If so, now is the time to celebrate!

If not, then it is time for a reality check and to be honest with yourself about what truly matters: How much did you spend on important things? How much did you save? How much did you give away?

These are all important questions when it comes to making sure that money is being used wisely and effectively.

Think about what is most important in your life and how much value those things bring—then compare that with how much money was spent on them.

The goal is not so much about cutting back as it is about spending more wisely—and knowing when something is worth the cost.

Do Not Avoid the Negative

The key to conducting a successful financial review is to remember that it’s not about being perfect but about making better decisions next year. So even if you are overspending or buying things you should not, try not to beat yourself up over it.

Instead, use these moments as an opportunity to learn from your mistakes and make better decisions in the future. Here are some questions you can ask yourself during your financial review:

Where could I have saved more money? What did I buy but rarely or never used? Can I sell them? Did I miss any important payments? Can I renegotiate any of my debt payments?

Reevaluate Your Payments

Next, look at any bills that have been piling up.

- Are there any late payments?

- Can those be renegotiated?

- Are there any subscriptions you can live without?

- Can they be automatic payments, so they don’t fall through again?

Finally, take stock of everything else:

- Did anything break or wear out this year?

- What did it cost to fix or replace it? Was it worth it?

- Will it still work on its own merits after another year or two alone (or do you need to do something about it now)?

This might seem overwhelming, but it is a healthy exercise to set up the right way for the next financial year.

This also does not have to be done in a day! Take your time with your review, and take a break if it gets too much.

Make a Realistic Financial Plan

To make a realistic financial plan, you must be honest about your goals.

It is tempting to think that being frugal is the way to go, but we have all seen people who have gone overboard and become so obsessed with saving money that they have no fun at all, and long-term planning ultimately fails.

That is not what financial planning is about! Instead, a realistic financial plan ensures that you have enough money for fun activities and can pay your bills on time. In other words, it means striking a balance between frugality and fun.

To do so, you need to know how much money you make each month and how much it costs to live where you live (including rent or mortgage payments).

It is essential to be realistic when making a budget because if you try too hard without knowing the actual numbers, then it will be impossible for you to stick with it long-term.

Fun things to do that cost almost nothing

If there is no room in your budget for fun, then time to get creative and do fun things for cheap! Here are some ideas for having the most fun possible without spending a dime.

Host a movie night

Everyone loves going to the movies, but it can be hard on your wallet when you have kids. So instead of going out, why not invite friends over for a movie night? Make sure everyone brings a dish or two and order pizza for everyone else. This is a great way to make new friends and enjoy some quality time together without breaking the bank!

Invite friends over for game night

Board games are an excellent way to spend time with family or friends without spending any money on entertainment. So find some of your favorites and make it an evening of laughs, strategy, and fun.

Plan an outdoor adventure

The outdoors is full of adventure, so why not plan one yourself? Start with something small like hiking or biking—you will be surprised how quickly your finances can add up if you are used to doing things indoors all day long.

Final Thoughts

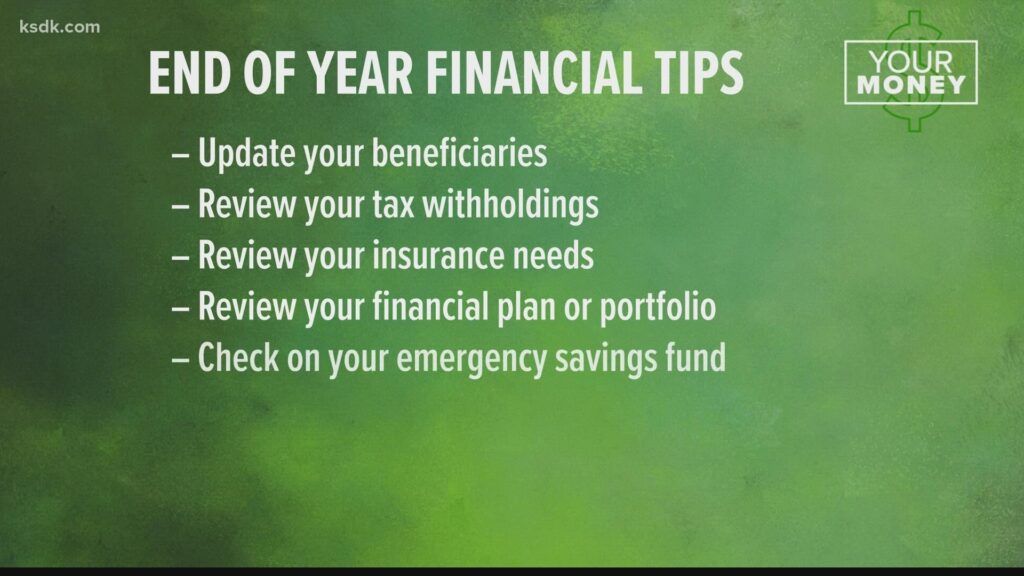

To summarize, here are the main takeaways for conducting your year-end financial review – and sticking to it.

1) List all income sources (wages, bonuses, interest earned from investments, etc.).

2) Write down all annual expenses (mortgage payments, utility bills, food costs, etc.).

3) Calculate your net worth by subtracting your overall expenses from all income sources (this will give you an idea of how much money is available for savings).

4) Adjust spending habits or increase savings contributions to avoid exceeding this amount each month/year.

5) Don’t forget to budget for fun!

Leave a Reply