Yes, I am a financial counselor and yes I bounced a check. When I shared this embarrassment with a client, he leaned back, smiled broadly and exclaimed, “Joe, that’s wonderful. This is something I can relate to! You should share this with all of your clients.”

OK Randy. How about the entire blogosphere? This is for you:

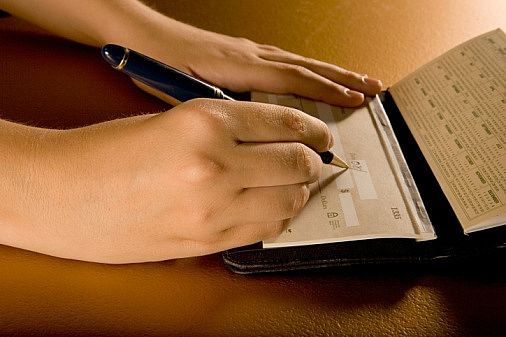

When I opened my bank statement last month, a negative balance jumped out at me. I scrutinized the statement, turned it over and back again to see if the minus sign might go away. No such luck. There were no notices, no overdraft fees, nothing nasty at all, just a negative balance. “How can this be?” I asked myself.

It happened just the way one would expect, but let me explain.

First, we have our savings and investments electronically transferred out of our checking account every month, leaving a buffer amount in the checking account in order to avoid overdrafts. As long as we live on our budget, all is well. However, when coupled with reasons two and three below, the buffer amount was not enough and all was not well.

Second, we made an arithmetic mistake on our check ledger. We thought we had more money that we actually had.

Third, we were lax at posting a couple of debit card charges.

Put those all together and you have a bounced check. Actually, I didn’t realize a check had bounced by looking at the bank statement; that bit of news was in a separate and very thin letter from the bank.

We do small town banking, so I drove to the bank and asked the teller why I wasn’t charged an overdraft for my misdemeanor. “Well”, she replied, “I can’t answer that, but I can say that our bank president reviews overdrafts and determines whether a charge is made.”

Don’t you love small town banks?

Then I called the business I bounced the check to. I apologized, explained that there were now sufficient funds in the account to cover the check and asked what, if anything, I needed to do to make it right. The bookkeeper didn’t know anything about it, but assured me that she would let me know if she needed anything from me. The call may not have been necessary, but I felt better having made it.

Hopefully, I have learned my lesson, but I cannot promise that it won’t happen again.

If it does, I will be sure to let you know. According to Randy, it should make you very happy.

Leave a Reply