Your wedding is one of the most anticipated days in your life. However, planning a dream wedding is not an easy-breezy task. It requires a great deal of preparation, time, and effort.

One of the biggest concerns is figuring out where and how to get enough funds to afford it without having to suffer financial debt.

The good news is you don’t need to deprive yourself of that dream wedding you’ve been praying for. There are many options to help you afford a decent and desirable wedding.

You only need to study your target budget and get your wedding details all sorted out. To learn more, here are the best ways to pay for a wedding.

Budgeting for your wedding

For any married couple, the first step, and the best way to fund your dream wedding with much ease and confidence is to make a detailed budget.

By setting a specific budget ahead of time, you can sort out which of the wedding details you need to prioritize or set aside.

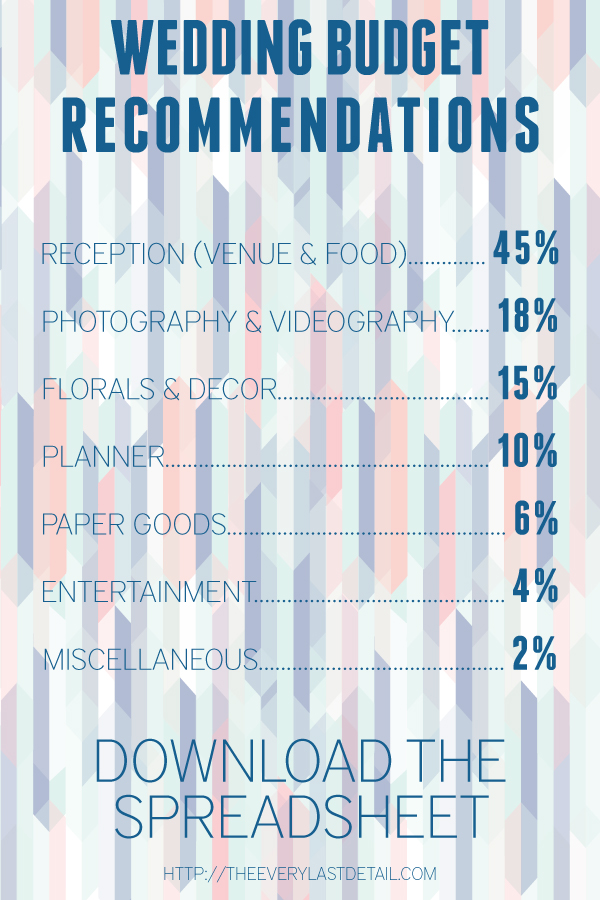

List all the known expenses and identify which of those are the absolutes, the must-haves, and the maybes, for you to get a good grasp of how you’re going to build your budget.

This target budget will be your constant reminder to monitor your cash flow closely and make sure you don’t overspend.

Once you have your list all sorted out, you may try cutting your budget on the maybes. For example, buy smaller bouquets and table centerpieces, or maybe, narrow down your ballooning guest list.

Saving up over time

Start saving up as early as you can. It’s the smartest way to gather funds without the worries and the hassle. It only takes a simple math equation.

Target Wedding Amount/ Number of Months Until the Wedding = Savings Each Month

To know how much you need to save each month, divide the target budget by the number of months remaining until your wedding.

If you need to cut back on your monthly expenses, like membership fees at the gym, expensive data plans, and other subscriptions, then you may do so. It’s a quick and effective way to get more funds.

Another good tip is to keep your wedding savings in one place, like a savings account to keep a record of the money coming in.

Borrowing from parents and family

When saving up is no longer possible, you can always ask your family, especially your parents, to help fund the wedding you’ve been dreaming of.

Besides, it’s a milestone in your life worth celebrating with the family. You just have to make sure that your parents or family members know where you are spending your money.

Credit cards and rewards

You might not want to use your credit card for the fear of drowning in debt, but you don’t have to strictly avoid them.

Credit cards will be useful for making deposits for early venue reservations and other major wedding suppliers while you are still saving up for the wedding. A bit of good advice is to use your credit card to pay for major wedding details, just make sure you immediately pay them off.

What’s more interesting are the lucrative reward points and welcome bonuses that can offset your expenses and may even give you an extra for your honeymoon or future home.

Just make sure that you pay your credit card balance in full as soon as possible, or else all your freebies will be canceled out.

Personal loan

If you still can’t afford to pay for your wedding, low-cost personal loans are your last resort. Often, banks tag personal loans as “wedding loans” as most people use them for this purpose.

https://www.weddingchicks.com/blog/when-to-put-wedding-expenses-on-a-credit-card-l-15937-l-12.html

Such types of loans are a good fit for your wedding needs because of the low-interest rates and easier payment terms. Just make sure that you have an excellent credit score or the interest rate may not make it worth your time.

Bottom line

Paying for your dream wedding can be stressful and worrisome, especially if you’re not prepared. Make sure you are ready with your target budget, you are saving up, and you keep track of all your wedding expenses.

Leave a Reply