Your HSA is more than a savings account used to pay for qualified medical expenses. It is an account that you can use to boost your retirement savings.

Many people automatically assume that a 401(k) or other contribution plans are the only way to maximize funds for your retirement age. Your HSA can be just as powerful, especially with its tax-free options.

This brief article will go over what an HSA is and how you can utilize its benefits to prepare for your retirement.

What Is an HSA? How Does It Work?

An HSA, also known as a Health Savings Account, is an account that is meant to help people cover the more expensive deductibles that come with a high deductible healthcare plan or an HDHP. You can only obtain an HSA if you have an HDHP.

An HSA provides you with the funds you need to pay for medical expenses that your high deductible healthcare plan may not cover.

If you are a very healthy individual who does not have a pre-existing condition and you only see your doctor for preventative care, then an HDHP plan may work best for you.

You can only have an HSA if you have an HDHP with a minimum deducible of $1,350 for an individual and $2,700 for a family.

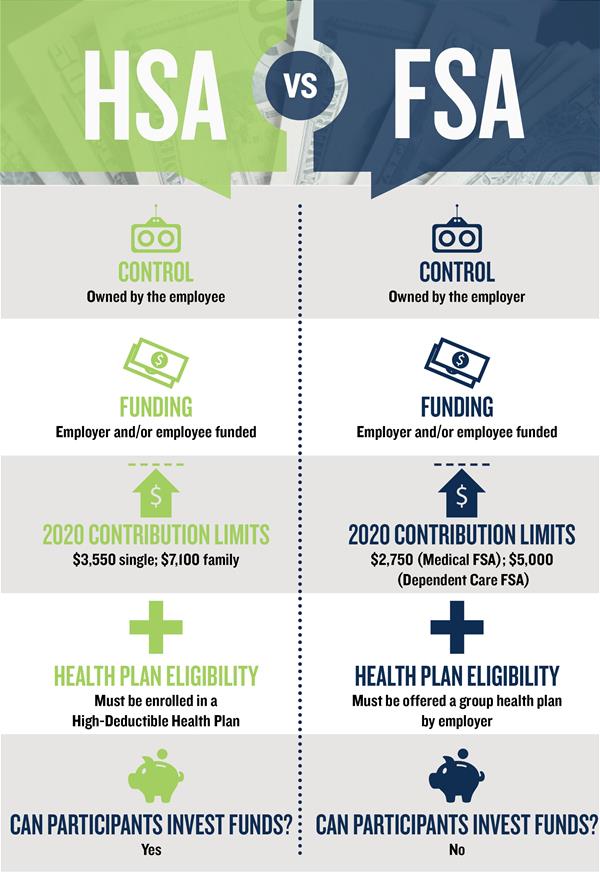

HSA vs. FSA

The major difference between an HSA and an FSA is that the funds in an HSA can be rolled over into another HSA account, and the funds in that account can be rolled over into the following year.

FSA accounts, also known as Flex Spending Accounts, are not as flexible and are owned by your employer.

You must spend the money in your FSA the same year that they were allocated. Anything you did not spend cannot roll over into the following year.

If you obtained an HSA through an employer and decide to leave the company, you can roll those HSA funds into another HSA account. FSA funds cannot follow you to your next job.

HSAs and FSAs both allow people to use pre-tax money to pay for their qualified medical expenses.

Save Your HSA Contributions

If you are a considerably healthy person who only goes to the doctor for preventative care, you can save your HSA contributions for the future.

If you possible, pay cash out of pocket for your medical bills and contribute more money to your HSA.

Money allocated into the HSA account is not taxed, whether it comes from you personally or from your employer.

When you use your own money to fund your HSA, that money is tax-deductible. Meaning that it can reduce your federal and state tax liability. As a bonus, that contribution is not subject to FICA taxes.

For the year 2021, the max that you can contribute on a self-only plan is $3,600. If you have dependents on your project, you can contribute up to $7,200.

Another great thing about your HSA is if you are over the age of 55, you can contribute an additional $1,000 a year to the account.

Plan to Use Your HSA in Retirement

If you need to use your funds from your HSA for things other than qualified medical expenses before the age of 65, you will be subject to state and federal taxes and a 20% penalty fee.

Once you pass 65, you will not be subject to the 20% penalty fee, but you will still be liable for the state and federal taxes.

Even if you retire before the age of 65, you can still use your HSA for qualified medical expenses. You can withdraw from that account without any tax penalties.

Examples of qualified tax-free expenses:

- Dental visits and expenses

- Eye exams and glasses

- Copayments for doctor’s office visits

- Prescriptions

- Medicare premiums

- Long term care such as retirement home fees and in-home nursing care

- Physical therapy

- Surgeries

- Insulin

- Artificial teeth

- Wheelchair or walkers

If you have dependents or a spouse that you claim on your taxes, you can use your HSA funds to help pay for their qualified medical expenses.

Adding a Beneficiary

Just like your 401k, when you open your Health Spending Account, you will be asked to designate a beneficiary to leave the funds to when you pass away.

If you are married and put your spouse as the listed beneficiary, they will obtain the balance on your HSA tax-free.

Anyone else listed that is not your spouse will be subject to taxes upon acceptance of the balance.

Final Thoughts

Contributing to your HSA in addition to what your employer puts into your account will make a massive difference when you retire.

Try to put at least $100 per month into your HSA account and watch it grow exponentially.

Leave a Reply