While SPACs are a legitimate investment for individual investors, they usually lose out on their investment. Most experts believe that SPACs, or blank check companies, are not a good investment idea.

Special purpose acquisition companies are a relatively new trend. Because investors get their money back if the SPAC doesn’t find an acquisition target, it seems like there is no risk. However, SPAC investing does have its risks.

This article describes SPAC investing and the possible risks of investing in a SPAC.

What Is a SPAC?

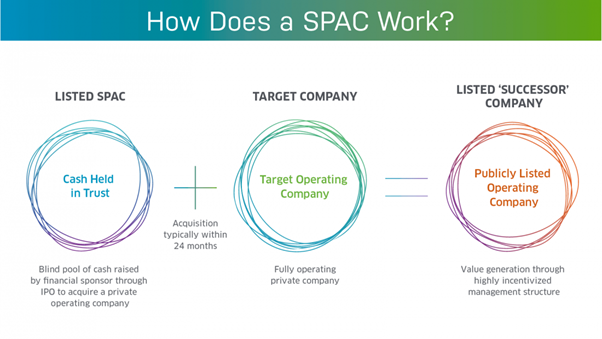

A SPAC is a Special Purpose Acquisition Company. SPACs are companies that want to purchase a private company.

SPACs, or blank check companies, are publicly traded companies that purchase private companies through what is known as a reverse merger.

SPACs raise capital through IPOs, or initial public offerings, which allows them to purchase private companies.

Private Companies

Private companies want to be bought out by SPACs because it is easier than going through IPOs. Also, the founders of these private companies can sell more of their ownership percentage through a reverse merger compared to an IPO.

Private companies are willing to be bought out by SPACs because it allows them to avoid the lock-up period, which is a specific timeframe in which they can sell shares, that is required for IPOs.

How Do SPACs Work?

As mentioned before, SPACs raise capital through IPOs, or initial public offerings. Investors who purchase stock from SPACs can exercise warrants, which allows them to purchase more stock shares once the transaction is over.

https://www.theverge.com/21502700/spac-explained-meaning-special-purpose-acquisition-company

Warrants are set for about 15% more than the IPO price. Once the IPO is over, the warrant trades separately. 85% of the IPO proceeds should be placed in an escrow account. However, in practice, about 97% goes into the escrow account. These funds are then used to invest in government bonds.

Potential Acquisition Target

SPACs then search for a potential acquisition target. While they are searching, they usually trade their stocks near IPO price. If SPACs are confident they will find a good acquisition target, they can trade their stocks at a higher price.

SPACs will have up to two years to find an acquisition target. If they don’t find one in the two years, the money is returned to the shareholders.

If they do find an acquisition target, they will announce it publicly before negotiating the acquisition structure. Then the shareholders will vote in approval or disapproval of the acquisition. They also have the option to liquidate their share for a portion of the money remaining in the account.

As long as most shareholders vote in approval, the acquisition will go through. The acquired firm will then be listed on the stock exchange.

If shareholders voted in disapproval, the escrow account is then closed and the money goes back to the shareholders.

Is a SPAC a Legitimate Investment?

Yes, a SPAC is a legitimate investment. However, there are a lot of criticisms when it comes to SPAC investments. The main criticism is that SPAC sponsors receive a large stock allocation during the IPO.

The warrants available for purchase allow management to claim up to 20% of the stock share total. This large share dilutes common stockholders’ shares.

Should You Invest In SPAC?

SPAC investing is not usually profitable for individual investors because most SPACs do not reach performance goals and do not reach the IPO price.

- SPACS typically underperform IPOs, so it is not recommended to invest in SPACs.

- On average, individual investors in a SPAC lose 12% of their investment.

Shareholder dilution makes SPAC stocks even less profitable for common shareholders. Some believe that SPAC investments are a way for financiers to put most of the risk on everyday investors and that they are a fad in investing.

Others believe SPAC investing can be a good idea for investors. Even though investing in SPACs is risky, it allows investors to choose from a wide range of companies.

SPAC investing is not risk-free. Even though investors get their money back after two years if the SPAC did not find an acquisition target, they will still most likely lose money. SPACs usually underperform the IPO price.

Most professionals agree that SPAC investing is not the smartest investment. Some believe that SPACs are a way to put the risk of investing on individual investors and give the investors a diluted share if the SPAC performs well.

Leave a Reply