In the wake of Covid-19, many people have started to look into having multiple revenue streams.

With the uncertainty many of us faced in early 2020, there is an added incentive to having multiple sources of income as well.

One way to do this is to invest. Every good financial advisor will recommend using asset allocation in order to both protect the initial investment, as well as see growth.

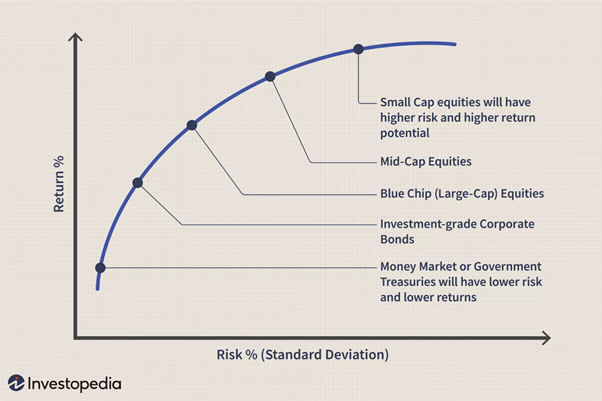

Asset allocation is the act of diversifying your investment portfolio. It is used to combat market volatility, while still allowing the investor to see growth within their investments.

Where you decide to allocate your assets will depend on a variety of factors, such as:

- Age,

- Risk tolerance, and

- Goals.

Why Do People Invest?

For many, investing is used as income during retirement. Depending on how young you are when you begin your investing journey, you will have more time to grow through market spikes.

If you were to put $1,000 into your account at 25, and the market crashes, meaning you lose most of this initial investment, you will have time to recover.

The market will always bounce back, it just takes some time. If you are 55 when you begin investing, you have less time before retirement to recover lost funds.

There are many strategies you can employ when looking to divide your assets, and everyone’s personal tastes will be different.

The following provides an insight into 3 different approaches to asset allocation, based on a low, medium, or high risk tolerance.

https://corporatefinanceinstitute.com/resources/knowledge/strategy/asset-allocation/

#1. Insured Asset Allocation

A low-risk form of asset allocation is called Insured Asset Allocation.

Insured asset allocation establishes a value in which your portfolio is not allowed to drop below. This would mean that so long as you achieve a positive Return on Investment (ROI), you can continue to buy, hold, or sell your shares, and try to increase your portfolio.

However, if your portfolio begins to stop doing well, and drops down to that pre-established base or low value, you will invest in risk-free assets or low-risk assets.

Should this ever happen, you can speak with your advisor about whether this strategy is working for you, and look into reallocating your investments.

Pros of Insured Asset Allocation

- Able to maintain a baseline asset

- Won’t lose money

- See growth without loss

- Good for people close to or of retirement age

Cons of Insured Asset Allocation

- Low volatility means smaller opportunities for growth

- Not as beneficial for younger investors, who have time to let their assets recover

#2. Constant-Weighting Asset Allocation

Constant-Weighing Asset Allocation is perfect for medium-risk investors.

- This strategy would mean if one of your investments starts losing value, you would buy more of the investment.

- Similarly, if one of your investments starts increasing in value, you would sell it. This would allow for you to be able to constantly balance your portfolio, trying to keep your assets within 5% of their original value.

It is a medium-risk, as you do allow yourself the potential for losses, and depending on the market, your losses can be great. However, you do not see a lot of growth either, as you are trying to maintain what you put in, and not go too far above it.

Pros to Constant-Weighting Asset Allocation

- Good for beginners to get used to the market without losing initial investment

- If the market only rises, there will always be a 5% growth

Cons to Constant-Weighting Asset Allocation

- Long-haul investors will see a smaller profit than more aggressive forms of investing

- You can lose out on greater margins of profit, always selling at a 5% gain, instead of allowing the investment to climb higher

#3. Tactical Asset Allocation

Tactical Asset Allocation is best used for short-term goals or gains, but it is considered to be a high-risk investment strategy. This is the strategy used when you have interesting investment opportunities.

Most recently in investing, Game Stop (GME) and AMC theatres (AMC) have proven to be a good investment opportunity for investors. Many were able to make a great ROI if they purchased these early, and waited to sell while they were high.

In order to have success with tactical asset allocation, you have to time the market correctly. If you buy too late, you won’t see a great ROI. Sell too early and you could miss out on a ton of profits.

Pros to Tactical Asset Allocation

- Can be quite prosperous with the right investment opportunities

- Good for those who are experienced at investing

Cons to Tactical Asset Allocation

- It is very high risk and could lead to losing your entire investment

- Should never be your entire portfolio, due to its volatility

The Takeaway

These are by no means every option when it comes to asset allocation, but they are popular options. You can also use a combination of the investment strategies above as your preferred means of asset allocation. Read more at the link below:

https://www.fool.com/investing/2018/07/25/a-modern-approach-to-asset-allocation.aspx

You have many options at your disposal, it’s all about discovering which strategy or combination of strategies works best for you.

It’s recommended to speak with someone before making any big financial decisions, but remember ultimately it’s important to make the best decision for your personal situation.

Leave a Reply